I was privileged to be invited to talk on the subject of investing. The demographics of the audience was predominantly Africans in the diaspora including those that the recent wave of mass immigration popularly referred to as ‘japa’ brought to the shores of United Kingdom through the tier 4 and and tier-2 visas.

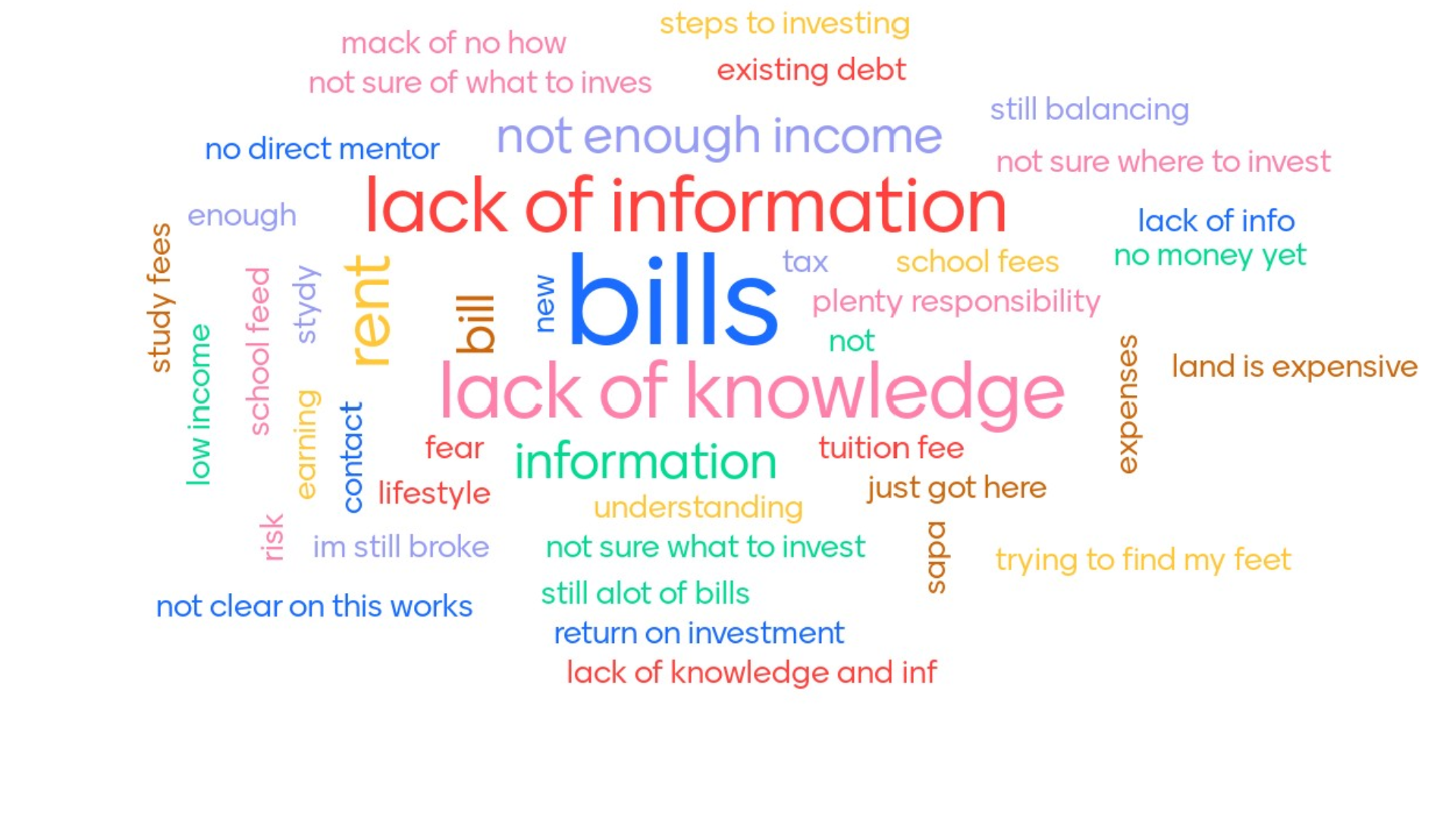

As part of my icebreaker session, I conducted a survey asking people to answer three questions relating to what assets they invest in, the investment platforms they use, and lastly (which is the focus of the piece) the reasons for not investing in the UK.

The most prominent response in the word cloud showed bills and it siblings (such as plenty responsibilities, lifestyle, low income, I am still broke, not enough income, expenses, lots of bills) as one of the major reasons for not investing in the UK.

However taking a closer look at the word cloud, lack of information seems to be the commonest reason why people are not investing but BILLS also could not be ignored .

Bills Bills Bills

Never ending, ever paying

When I think I have you under control, You suddenly invite another bunk mate

Like a rash you spread

You eat into my meagre pay cheque

Which already is plagued with Uncle Charlie’s taxes

Inflation too come add im own as he dey erode away its purchasing power

You don forget say na from far I come

And na greener pasture I dey find

You are such a pest!!!

What can I use to curb your spread

BILLS! BILLS!! BILLS!!! 😫

Don’t mind my attempt at poetry – I’m no Shakespeare. But seriously, it’s a bit of a conundrum when you’ve got several direct debits and standing orders draining your pay cheque faster than a ninja on roller skates. How can anyone plan for the future? I’m talking about that dreamy early retirement where you can wake up whenever you want, do whatever tickles your fancy, and let your money do all the hard work for you, 24/7.

Sure, the rising cost of living is a formidable adversary when it comes to saving and investing (as I love to say, “Pay yourself first!”), but will it still be a valid excuse 20 to 30 years down the line especially if all you’ve got to lean on is your work place pension? And what about those of us who march to the beat of our own drum as self-employed workers and contractors? You folks need superhero-level of discipline to make contributions towards your own pension!

There is this common quote from the richest man in Babylon (a classic on Personal finances and investing) which says “A part of what you earn is yours to keep” and another quote from the same book says “What each of us call our necessary expenses will always rise to meet our income unless you protest to the contrary”

The keyword there is ‘Protest’ – that is ‘taking it by force!’

So what am I doing about this monster called Bills?

I’m staging an all-out revolt against Lifestyle Creep.

I’m reclaiming what rightfully belongs to my future through the fine art of budgeting. And what do I do with those hard-earned savings? I tuck them safely away in a Stock and Shares ISA and SIPP (note there is zero capital gains tax on these).

I recently read about the thousands of ISA millionaires in this country, who are enjoying their tax-free interest like fine wine. I’m determined to join their ranks; even if I don’t hit the seven-figure mark, a comfy nest egg should do just fine.

Thank you for reading ‘how are you taming this monster called Bills?’.

Original article culled from @IBWFG (www.ibwfg.com)