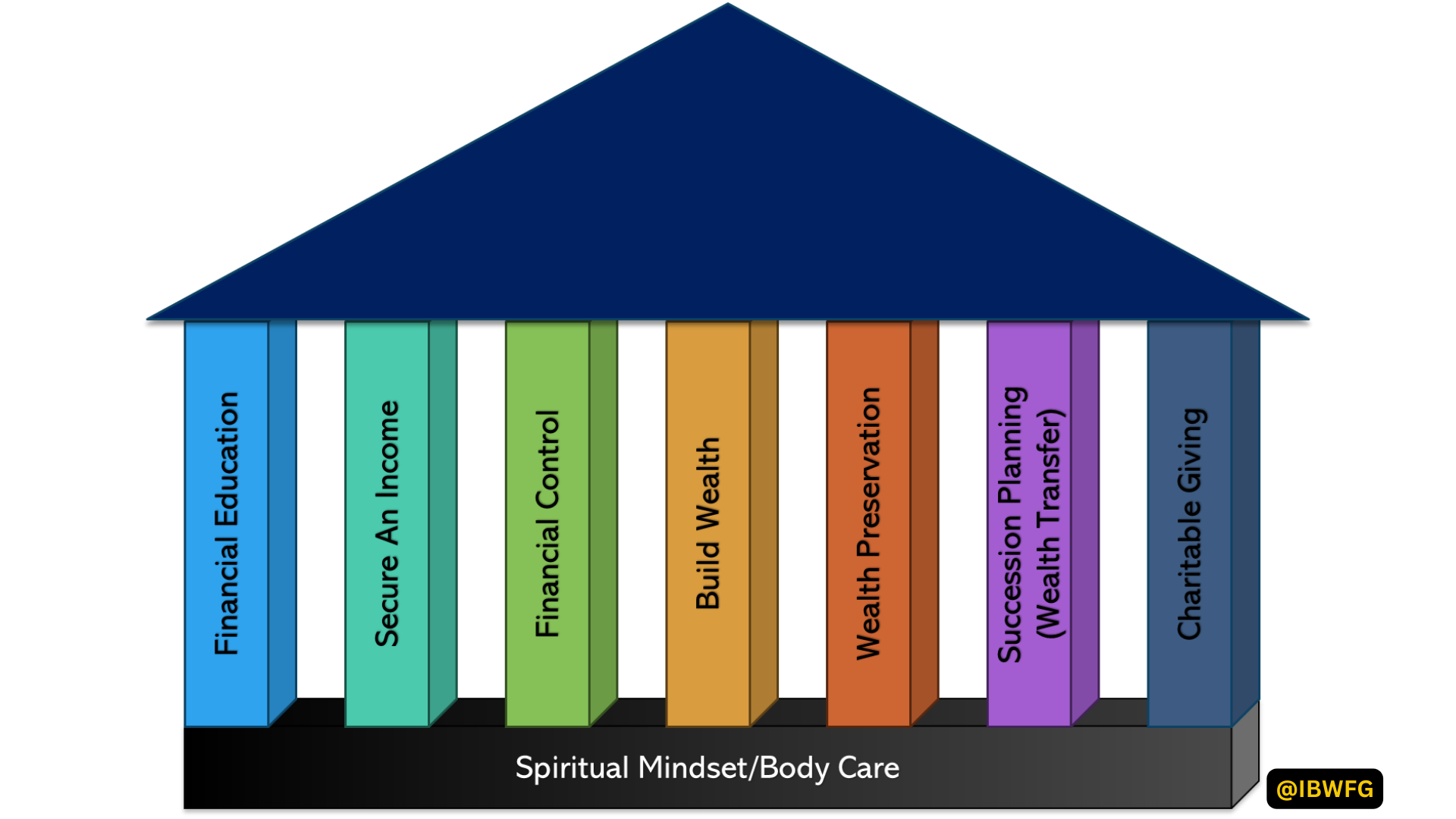

Wealth creation is a deliberate and enduring endeavour, akin to constructing a lasting monument. In the face of economic challenges, what we build today should transcend our own lifetimes and benefit generations to come. To achieve this, we present the seven essential pillars of wealth building, each firmly grounded in the foundation of possessing the right spiritual mindset towards money, often referred to as money psychology, and maintaining good health—a common saying being that health is indeed wealth. Below are the seven pillars, beginning with their foundational elements:

Foundation 1: Spiritual Mindset or psychology of money

Building wealth begins with cultivating the right mindset, often known as the ‘psychology of money.’ This mindset involves recognizing and breaking free from negative beliefs like poverty and scarcity, as well as learned helplessness. It’s about feeling comfortable with the idea of wealth and even embracing the belief in a divine covenant of blessings, especially for those of the Christian faith. Moreover, it means seeing the mission in leaving an inheritance for future generations and seeking guidance through divine direction or intuition, sometimes called a hunch, which relies on feelings rather than just empirical evidence.

Foundation 2 – Good Health is Wealth

A key foundation for building wealth is maintaining good health. This means taking care of your mind, body, and spirit. To do this, you should focus on a few important things. Firstly, make sure to exercise regularly and eat a balanced diet. This will keep your body in good shape. Secondly, ensure you get enough rest and take care of your mental health. A healthy mind is crucial for making wise financial decisions. Lastly, have faith in yourself and your journey toward wealth, and don’t feel guilty about enjoying life along the way.

Pillar 1: Financial Education

- Establishing a strong foundation through financial education

- Acknowledging that ignorance can be costly

- Developing a discerning eye for opportunities

- Gaining confidence through education

- Receiving guidance and avoiding financial pitfalls

- Leveraging the wisdom and experience of mentors

Reading valuable books such as the following classics on investing and personal finance will be useful:

- “The Richest Man in Babylon” by George Samuel Clason,

- “Rich Dad Poor Dad” by Robert Kiyosaki and Sharon Lechter, and

- “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko.

Pillar 2: Secure a Source of Income (Earnings)

- Ensuring a steady source of income as the foundation

- Maintaining a consistent flow of income, like a constant supply of seeds

- Safeguarding and augmenting your income

- Recognizing that your current position is a stepping stone to your future

- Enhancing earning capacity through unexplored avenues, such as pursuing a professional career, changing professions, or negotiating for better compensation

- Creating supplementary income streams

- Living within your means and earning more than you spend

Pillar 3: Financial Control

- Adhering to the principle that expenses tend to expand to match income

- Guarding against lifestyle inflation by maintaining control over your spending

- Deliberately allocating resources

- Implementing budgeting techniques, such as the 50-30-20 rule (50% essentials, 30% personal spending, 20% savings and debt repayment)

Pillar 4: Strategic Wealth Building

- Automating savings and establishing a habit of setting aside a portion of your income

- Prudently avoiding personal debt

- Putting your financial resources to work through various investment avenues, including stocks, money markets, real estate, and business ventures

Pillar 5: Wealth Preservation

- Managing risks effectively through portfolio diversification and balancing

- Considering risk in relation to your age and financial goals

- Seeking professional tax advice to optimize tax strategies

Pillar 6: Succession Planning

- Educating and preparing the next generation for wealth management

- Ensuring a smooth transition of wealth through wills, trusts, and shareholdings

- Exploring the advantages of establishing a family office—a comprehensive private wealth management service catering to ultra-high-net-worth families over multiple generations

Pillar 7: Charitable Giving

- Contributing to causes that resonate with your values and beliefs

- Recognizing the blessings that come from charitable giving, as it is often said, “You lend to the Lord when you give”

- Exploring opportunities for philanthropic contributions to causes dear to your heart, as exemplified in Forbes’ list of the most philanthropic billionaires in 2022.

Incorporating these seven pillars and their foundational elements into your wealth-building journey will pave the way for a legacy that extends beyond your lifetime, benefiting both your family and society at large.